Core Policy System Modernization

ASSA Compañía de Seguros — Central America

Product Designer → Product Owner–oriented Role

⏱ 3.5 years | 🌎 Multi-country platform

🧩 Product Overview

Product: Core Policy Administration System

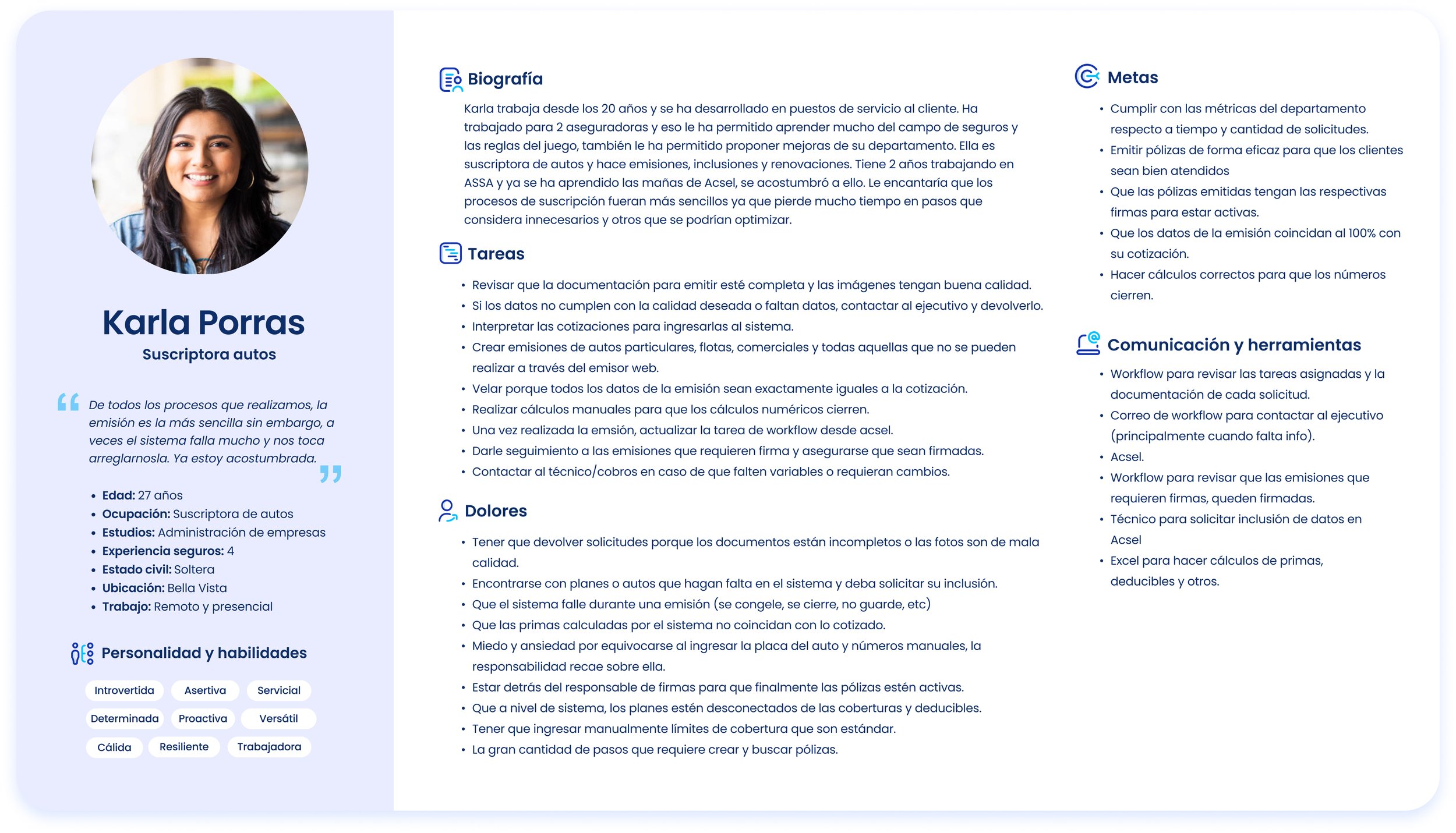

Users: Technical users, underwriters, operations, supervisors, managers

Markets: Multiple countries across Central America

Type: Internal, mission-critical enterprise platform

What this product does:

The core policy system manages the entire insurance policy lifecycle, including:

Policy issuance

Renewals

Endorsements

Cancellations

It is a backbone system used daily by multiple departments with different business rules per country.

💡 As a Product designer, I focused on aligning user needs, business rules, and technical feasibility across markets.

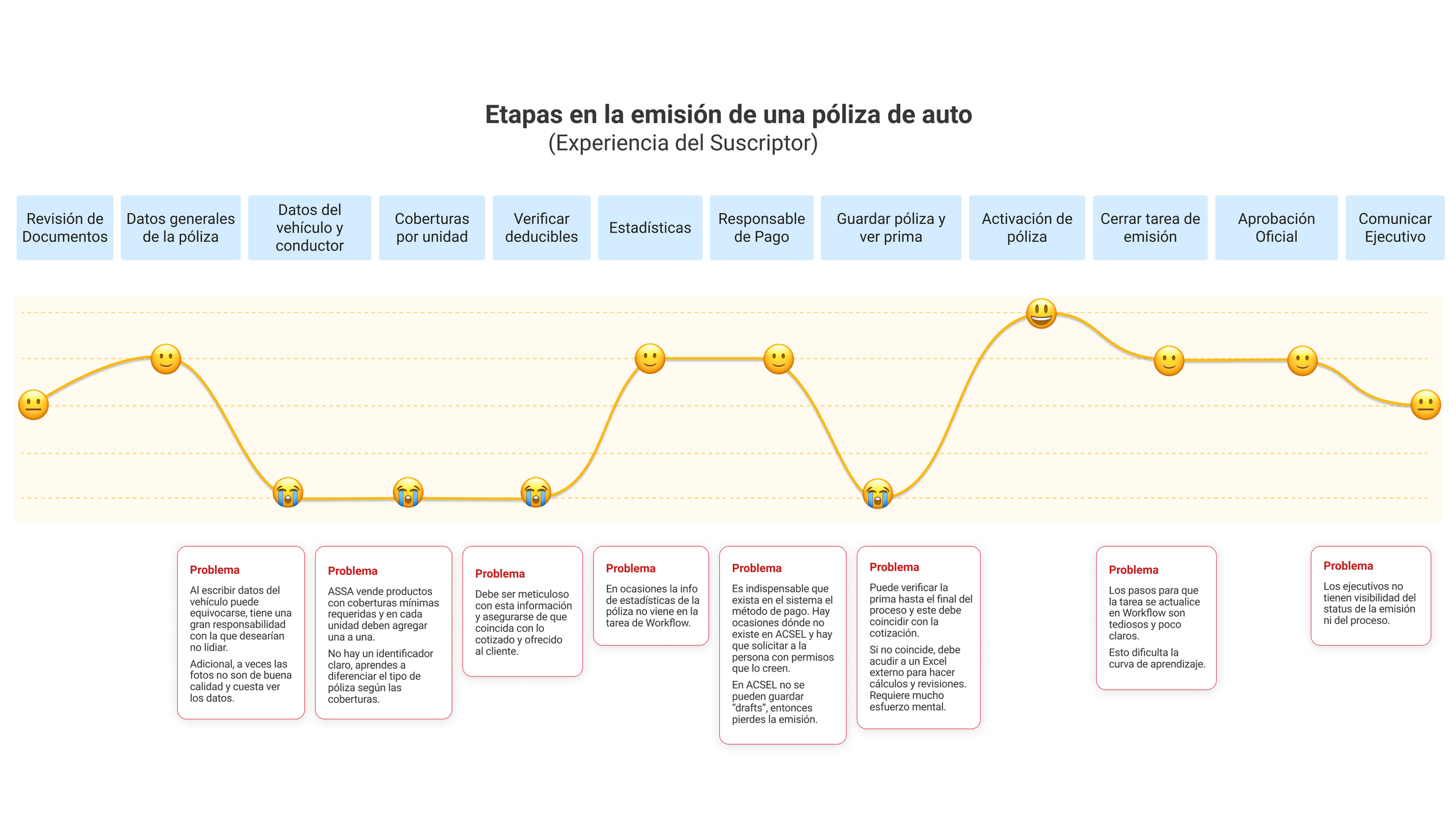

🎯 Problem Definition

Business & User Problems

Legacy workflows were slow, error-prone, and hard to scale

High learning curve for new users

Inconsistent experiences between countries

Limited visibility into user pain points and system performance

Business Risks

Operational inefficiencies

Increased support and training costs

Resistance to adoption

Difficulty evolving the platform

🧠 My Role

Although my title was Product Designer, my responsibilities strongly aligned with Product Owner / Product Manager functions.

I acted as the bridge between users, business stakeholders, and development teams, owning the problem space and solution definition.

I collaborated with:

Technical users across multiple business departments

Users from different Central American countries

Managers and supervisors defining operational priorities

Developers and engineering teams defining feasible solutions

🔍 Discovery & Requirements Definition

What I did as a PD:

Gathered and synthesized requirements from multiple countries and departments

Identified shared vs. local needs to avoid fragmentation

Prioritized problems based on business impact and user pain

Translated complex insurance rules into clear user workflows

Research & Discovery Tools

Surveys & structured feedback → Microsoft Forms

Usability testing & task success metrics → Maze

Discovery workshops & journey mapping → FigJam

Behavioral insights & friction analysis → Hotjar

Output: Clear problem statements, validated workflows, and prioritized feature improvements.

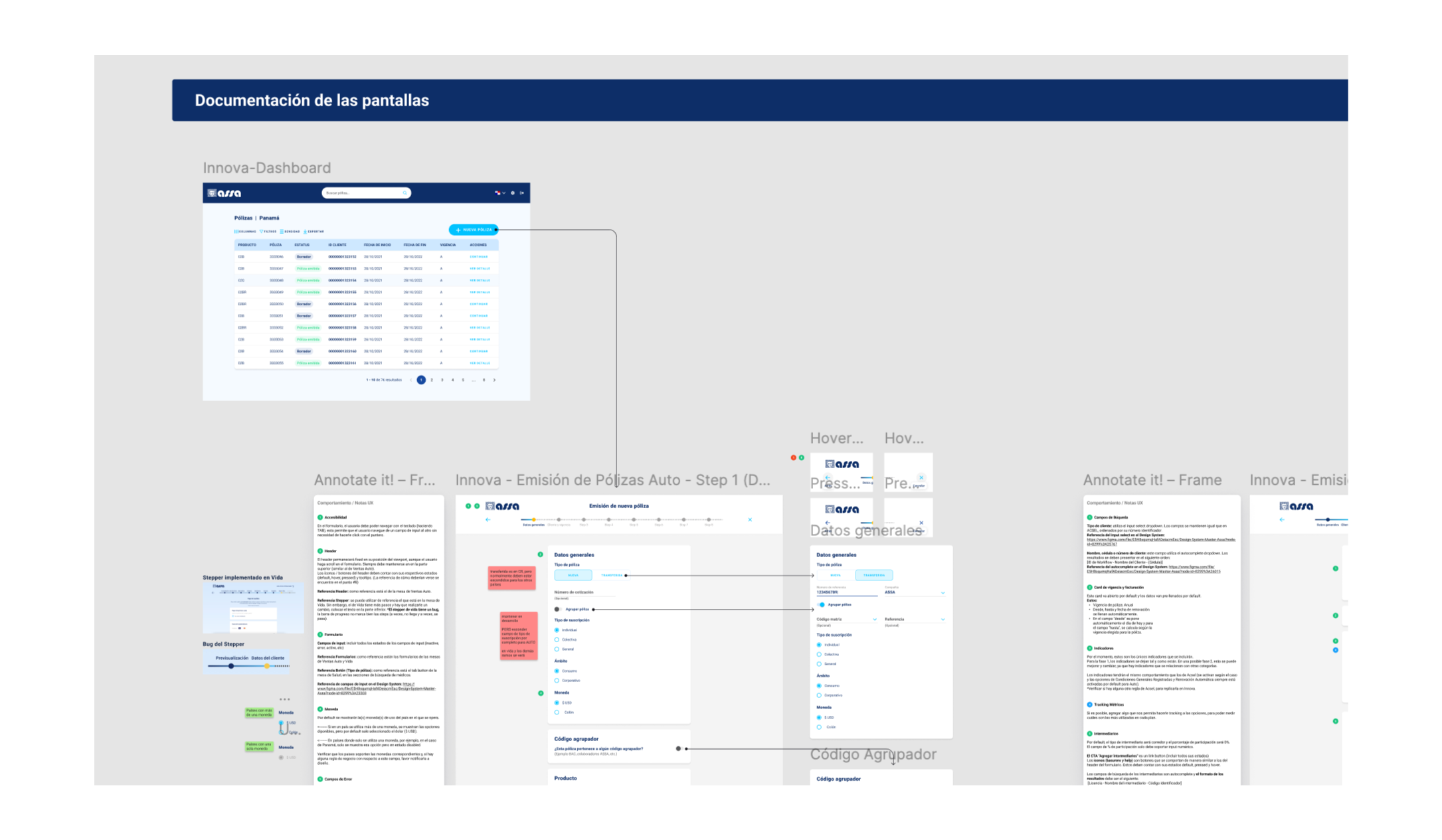

🗺 Defining the Solution

Core Product Decisions

Standardize workflows while allowing regional flexibility

Reduce cognitive load in high-risk tasks

Improve clarity in decision points and validations

Design for scalability and future insurance products

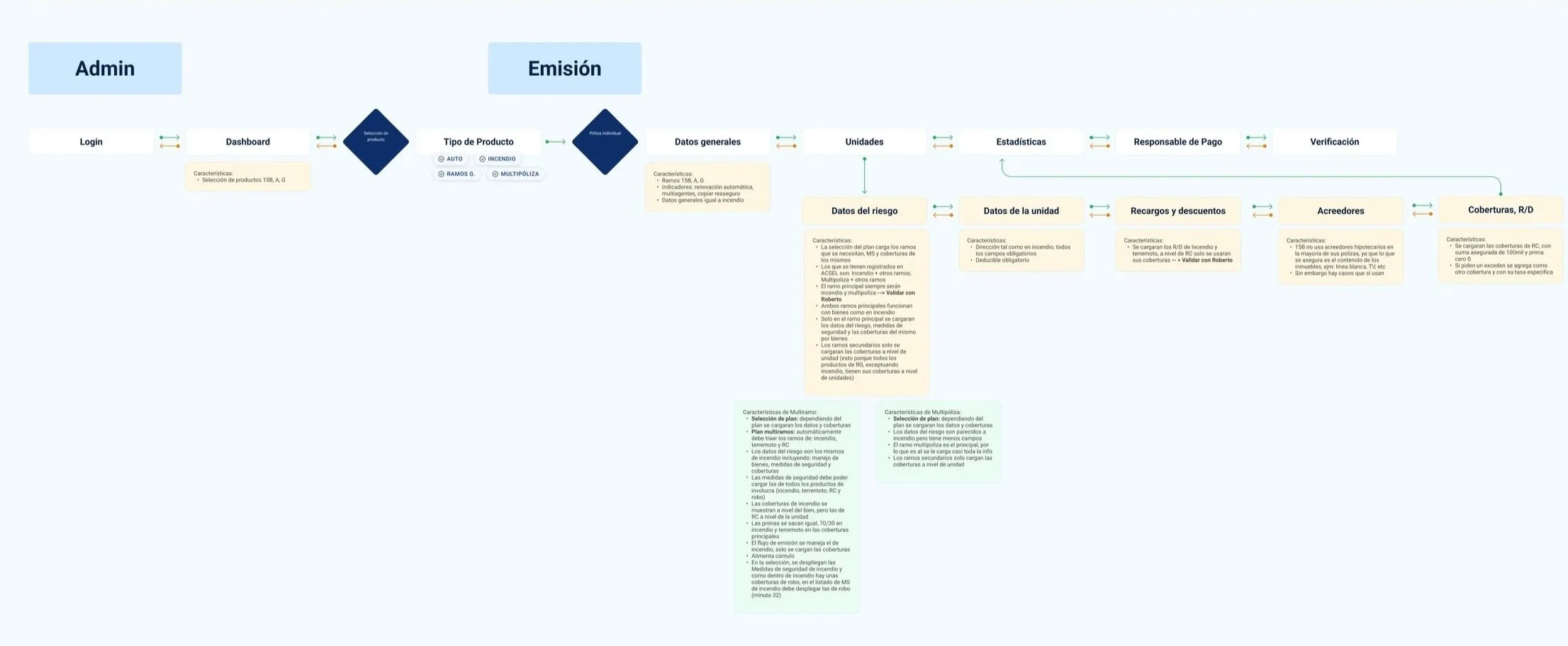

Key Workflows Redesigned

Policy issuance

Renewals

Endorsements

Cancellations

Each flow was redesigned end-to-end, from input logic to edge cases.

🧪 Validation & Iteration

Before and after implementation, I ensured solutions were validated through:

Usability testing with real users

Task completion and effort measurement

Continuous feedback loops with supervisors and managers

Close collaboration with developers during implementation

This reduced rework and increased adoption at launch.

📈 Outcomes & Impact

Product Metrics

~80% user satisfaction

Customer Effort Score (CES): 4.5 / 5

Net Promoter Score (NPS): 50

Business Impact

Increased adoption across regions

Reduced errors in critical policy operations

Faster onboarding for new users

Improved alignment between business rules and system behavior

These metrics validated both product decisions and prioritization strategy.